The Hustler Fund aims to empower entrepreneurs and small businesses by providing capital for business start-ups, expansions, and other financial needs.

It was launched on 30th November 2022. All entrepreneurs and small businesses in Kenya can access Hustler Fund through the short code *254# on most mobile network operators. To help you understand the Hustler Fund, here is a summary of everything you should know.

What Is Hustler Fund?

Hustler Fund is an initiative by the Kenyan government to provide capital for business start-ups, expansions, and other financial needs. It’s designed to help entrepreneurs and small businesses access affordable financial services.

The minimum loan amount for individuals is Ksh. 500, and the maximum amount is Ksh. 50,000. Micro-enterprises can borrow between Ksh50,000 and Ksh500,000. During the launch, the president noted that the launch of micro-loans between Ksh. 100,000 and Ksh. 5 million will take place in February 2023.

The repayment period is 14 days (2 weeks) at 8% interest per annum. For example, a loan of Ksh. 50,000 with a repayment period of 2 weeks will require a total repayment amount of Ksh. 50,154.

Apart from that, 5% of the loan will go to savings. To encourage a saving culture, the government will add 50% of the amount saved to the borrower’s savings account to a maximum of Ksh. 6,000.

How to Register for the Hustler Fund

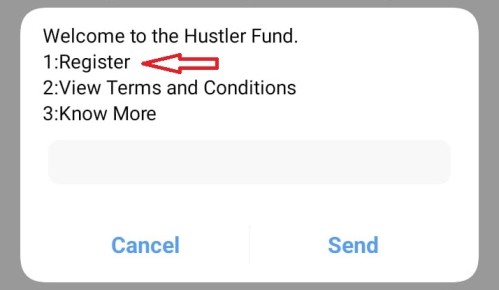

The registration process is pretty straightforward. If you have a registered Safaricom, Airtel, or Telkom line, you can follow these steps to register:

- Go to your mobile phone’s dial pad and type *254#

- You will receive a prompt to either register, view terms and conditions, or know more. Select option 1 (Register).

- The next step is to accept the terms and conditions. You can access the terms and conditions from this link (https://hustlerfund.go.ke). Select option 1.

- You will then receive a prompt to enter your mobile money (M-PESA, Airtel Money, or T-kash) PIN.

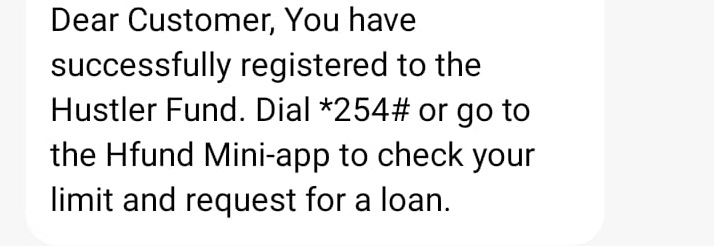

- After entering the PIN, you will receive a message indicating that your application has been received.

- After around 2 hours, you will receive a confirmation of successful registration.

How to Apply for the Hustler Fund

Are you wondering how you can apply for Hustler Fund? Here is the process to access the facility:

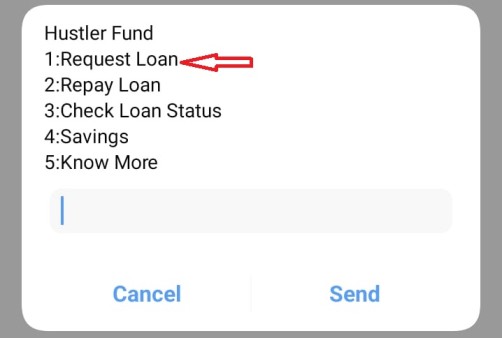

- Go to *254# and select option 1 (Request Loan).

- Next, you will get your loan limit, repayment, and interest rate. Enter a loan amount within your loan limit.

- You will get a prompt showing the amount you will get, savings to your scheme, and repayment date. Select option 1 to confirm your loan.

- The next step is to enter your mobile money (M-PESA, Airtel Money, or T-kash) PIN.

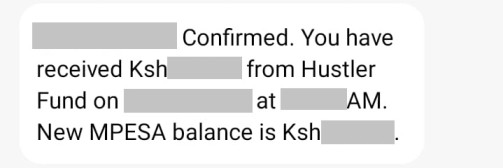

- After entering the PIN, you will receive a message indicating that your request will be processed shortly. You should receive a confirmation message within 2 hours and the amount will reflect in your money account.

How to Repay Hustler Fund

It is advisable to pay back your loan on time. Early loan repayment will help you build your credit score and qualify for bigger loans.

To pay back the Hustler Fund loan, you should follow these steps:

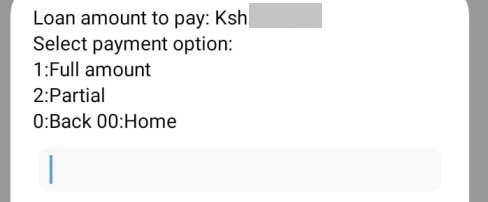

- Go to your mobile phone’s dial pad, type *254#, and select option 2 (Repay Loan).

- Select whether you want to repay the full or partial amount (Option 1 or 2).

- Next, you will get a prompt showing the amount and transaction cost. Select option 1 to confirm the payment.

- The next step is to enter your M-PESA, Airtel Money, or T-kash PIN.

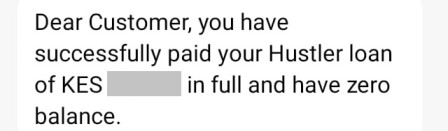

- After entering the PIN, you will receive a confirmation message indicating that your request is being proposed.

- Once your loan is repaid, you will receive a repayment confirmation message from your mobile money provider and Hustler Fund platform.

What Happens If You Don’t Repay the Hustler Fund Loan?

If you don’t repay the Hustler Fund loan, you will not be eligible for another loan from the service. The loan will also attract a higher interest rate of 9.5% p.a. if you don’t pay the loan 15 days after the due date.

There are also reminders 1 day before the due date, on the due date, and every 5 days for 30 days if you don’t pay the loan.

If you want to increase your hustler fund loan limit and the repayment period, you should repay on time. This will help you build a good credit score and access higher loans in the future.

Hustler Fund App

It is good to note that the Hustlers Hund has no application. Any app running under that name is trying to scam Kenyans by requesting approval fees. Therefore, it is advisable to stay away from such apps, or you risk losing your hard-earned money.

Conclusion

The Hustler Fund is an innovative service from the government of Kenya that provides micro-loans to small businesses and individuals. The service makes it easy for borrowers to access funds without collateral.

If you want to take advantage of this service, it is important to understand how to register for Hustler Fund, how the application process works, and how to repay the loan on time.